TomoCredit — Onboarding Redesign: From Drop-Offs to Activation

Product Strategy

Impact

+52% increase in activation completion (Q3 2025).

−31% drop in setup-related support tickets.

↑ retention and engagement due to improved education during onboarding.

Provided leadership with a clear UX framework to scale future feature rollouts.

2. Journey Mapping & Information Architecture

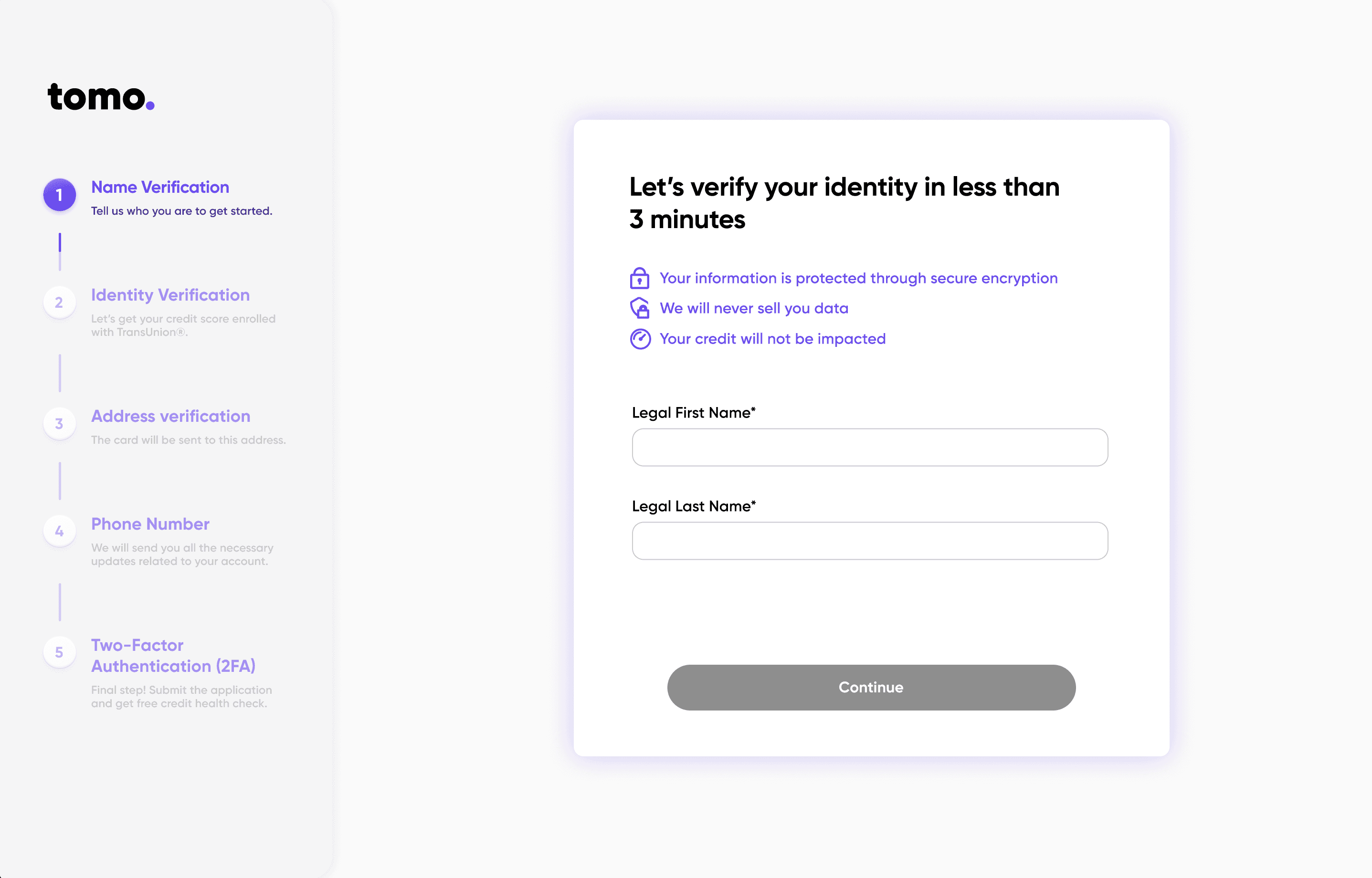

Created a new onboarding journey map covering pre-sign-up education → KYC verification → first payment setup.

Reduced total user actions from one long form into 5 steps/ 5 screens, introducing progressive disclosure and auto-filled states.

UX & Visual Design

Built a cohesive design system for onboarding components (cards, modals, checklists).

Introduced a “trust layer” using verified partner logos, FDIC security badges, and humanized illustrations.

Added step indicators and contextual microcopy explaining the “why” behind each data request.

Engineering Collaboration

Partnered with engineers to implement real-time form validation and session persistence (so users could resume onboarding).

Integrating TU 2FA

Coordinated design QA across mobile and web environments.

Launch & Optimization

Launched A/B test for the new flow on Sep 25, 2025.

Monitored GA4 and Firebase event funnels for post-activation behavior.